The Facts About Kam Financial & Realty, Inc. Uncovered

The Facts About Kam Financial & Realty, Inc. Uncovered

Blog Article

Not known Details About Kam Financial & Realty, Inc.

Table of ContentsThe Kam Financial & Realty, Inc. StatementsGetting The Kam Financial & Realty, Inc. To WorkSome Known Incorrect Statements About Kam Financial & Realty, Inc. The Best Strategy To Use For Kam Financial & Realty, Inc.Not known Incorrect Statements About Kam Financial & Realty, Inc. How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.The Buzz on Kam Financial & Realty, Inc.

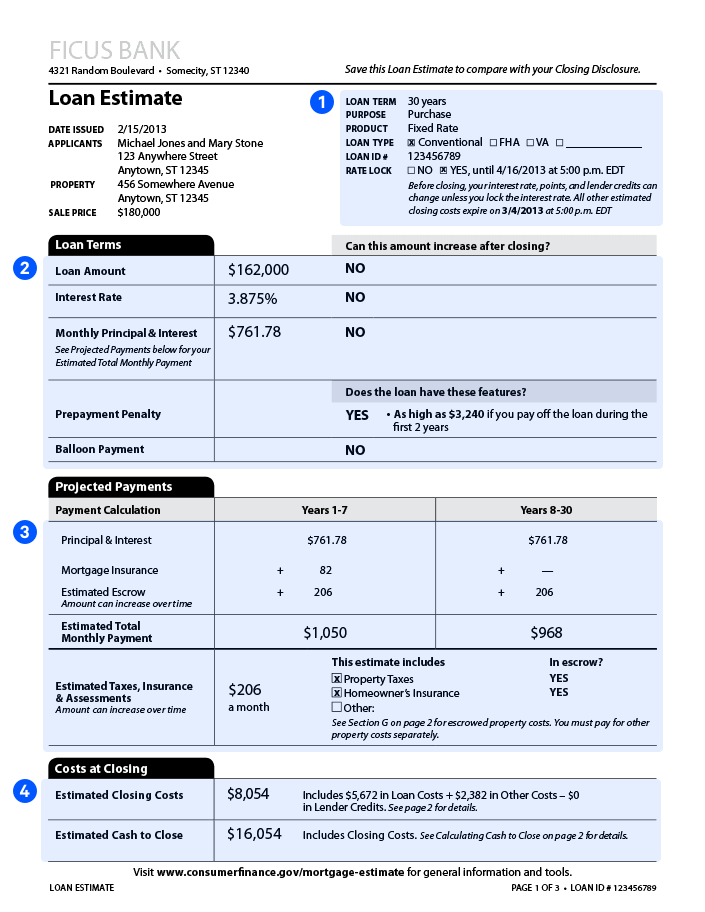

The home getting procedure involves numerous actions and variables, suggesting each person's experience will certainly be unique to their household, financial scenario, and preferred building. That does not indicate we can not help make sense of the home loan process.A is a type of funding you make use of to get property, such as a home. Typically, a loan provider will certainly offer you a set amount of money based on the worth of the home you desire to purchase or have.

Some Known Details About Kam Financial & Realty, Inc.

To get a mortgage, you will certainly require to be a minimum of 18 years of ages. Aspects that assist in the home loan process are a trustworthy earnings source, a strong credit rating, and a small debt-to-income proportion. https://www.4shared.com/u/16eNmNAC/luperector.html. You'll find out extra concerning these consider Component 2: A is when the house owner obtains a new home loan to replace the one they currently have in area

A functions in a similar way to an initial mortgage. You can obtain a set quantity of money based on your home's equity, and pay it off with taken care of monthly settlements over a set term. A runs a bit differently from a conventional home mortgage car loan and resembles a charge card. With a HELOC, you get authorization for a repaired quantity of money and have the adaptability to borrow what you require as you need it.

This co-signer will agree to pay on the home mortgage if the borrower does not pay as agreed. Title firms play an important duty ensuring the smooth transfer of building ownership. They research state and region documents to validate the "title", or possession of your home being purchased, is complimentary and clear of any kind of various other home mortgages or obligations.

The Definitive Guide for Kam Financial & Realty, Inc.

Additionally, they offer written guarantee to the borrowing institution and develop all the documentation needed for the home loan. A deposit is the quantity of cash money you should pay upfront in the direction of the acquisition of your home. If you are acquiring a home for $100,000 the lending institution may ask you for a down settlement of 5%, which suggests you would be required to have $5,000 in cash as the down settlement to get the home. https://www.blogtalkradio.com/kamfnnclr1ty.

Many loan providers have standard home loan guidelines that allow you to obtain a specific portion of the worth of the home. The percent of principal you can obtain will certainly differ based on the home loan program you qualify for.

There are special programs for new home customers, professionals, and low-income consumers that permit reduced deposits and greater portions of principal. A mortgage lender can examine these options with you to see if you certify at the time of application. Passion is what the lender costs you to borrow the cash to visit our website get the home.

Unknown Facts About Kam Financial & Realty, Inc.

If you were to get a 30-year (360 months) home loan and obtain that exact same $95,000 from the above instance, the total amount of passion you would certainly pay, if you made all 360 month-to-month settlements, would certainly be a little over $32,000. Your monthly payment for this financing would be $632.

When you possess a home or building you will certainly need to pay property tax obligations to the region where the home is located. The majority of lenders will certainly require you to pay your taxes with your home loan repayment. Building tax obligations on a $100,000 finance could be around $1,000 a year. The lending institution will split the $1,000 by 12 months and include it to your settlement.

Not known Details About Kam Financial & Realty, Inc.

Again, because the home is viewed as collateral by the loan provider, they intend to see to it it's safeguarded. Homeowners will certainly be needed to give a copy of the insurance plan to the loan provider. The yearly insurance plan for a $100,000 home will cost about $1,200 a year. Like tax obligations, the loan provider will certainly likewise offeror occasionally requireyou to include your insurance policy premium in your month-to-month repayment.

Your settlement now would increase by $100 to a new overall of $815.33$600 in concept, $32 in rate of interest, $83.33 in tax obligations, and $100 in insurance. The loan provider holds this money in the exact same escrow account as your residential property tax obligations and makes payments to the insurance coverage firm in your place. Closing costs refer to the expenditures connected with refining your car loan.

The 15-Second Trick For Kam Financial & Realty, Inc.

This ensures you comprehend the total expense and agree to proceed before the car loan is funded. There are many various programs and lending institutions you can pick from when you're getting a home and getting a mortgage that can help you navigate what programs or options will certainly function best for you.

The Ultimate Guide To Kam Financial & Realty, Inc.

Many economic organizations and actual estate agents can assist you recognize just how much cash you can invest on a home and what car loan quantity you will certainly get. Do some study, however additionally ask for references from your loved ones. Finding the right partners that are a great suitable for you can make all the difference.

Report this page